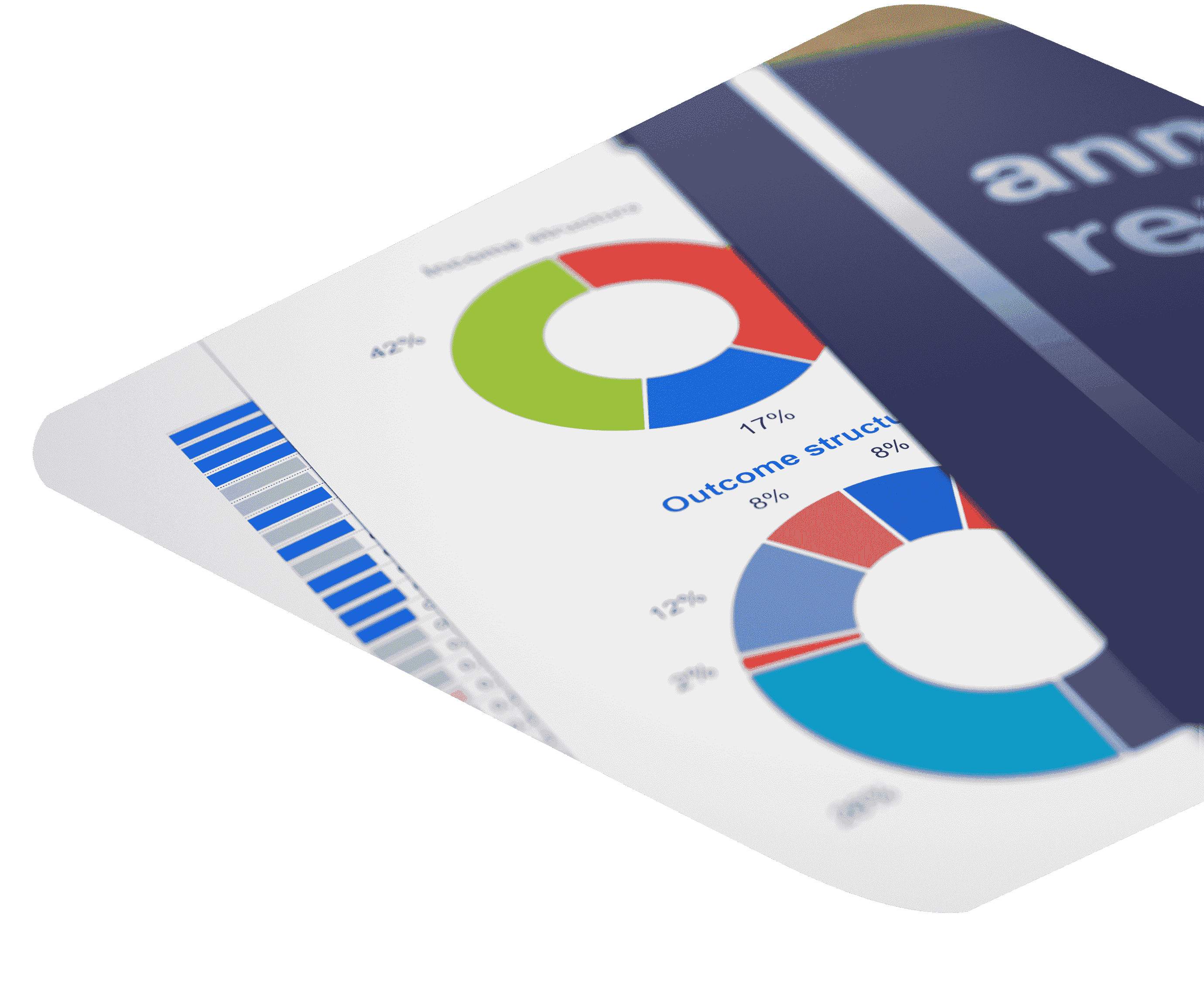

CORPORATE DEPOSIT

Successful organizations manage their liquidity by deploying it strategically to maximize their returns. If your organization is looking to earn attractive returns on your surplus liquidity, SAMAA FINANCE have Corporate Deposit scheme, to help you manage your excess funds. Our Corporate Deposit scheme not only enables you to earn attractive returns but also maintain access to your liquidity. Regulated by the Central Bank of UAE, SAMAA FINANCE offers Corporate Deposits for varying tenors and interest rates that provide you flexibility in managing your liquidity.